Financial Independence, Early Retirement (FIRE) is a movement of people dedicated to large savings and investment programs, designed to enable them to retire much earlier than traditional budgets and retirement plans allow.

Based on the bestselling book Your Money or Your Life by Vicky Robin and Joe Dominguez, FIRE incorporates the book’s main premise: to get people to evaluate each expense in terms of the number of hours it takes. this.

Financial Independence, Retire Early (FIRE)

The FIRE retirement movement is aimed squarely at the traditional retirement age of 65 and a growing industry to encourage people to design it. By devoting a large part of their income to savings, FIRE fans hope to quit their jobs before the age of 65 and make a living off of small withdrawals from their entire wallet.

According to Vox, in recent years, millennials, in particular, have called for a fiery withdrawal. Proponents of high-economy lifestyles tend to stay at work for years, saving up to 70% of their annual income. When their savings reach about 30 times their annual expenses, or about $1 million, they can quit their day job or retire altogether.

To make ends meet after retiring at a young age, FIRE enthusiasts withdraw a small amount from their savings, usually around 3% to 4% of their annual balance. Depending on the size of their savings and their desired lifestyle, monitoring their spending as well as their commitment to maintaining and redistributing their investments requires close attention.

Financial Independence, Retire Early

According to a Forbes Advisory report, there are many differences in FIRE pensions that determine the lifestyle that FIRE loyalists want to maintain.

Fat Fire – This is for someone who has a traditional lifestyle and aims to save more than the average worker, but doesn’t want to lower their current standard of living. It generally requires a high salary and a strong savings and investment strategy to be successful.

Lean Fire – this requires strict adherence to the minimum standard of living and extreme austerity, which leads to a stricter lifestyle. Many Lean Fire fans make $25,000 a year or less.

Barista Fire – This is for those who want to fall between the two options listed above. They quit their traditional 9 to 5 job, but use a combination of part-time and savings to lead a simple lifestyle. The former allows them to have health insurance, while the latter prevents them from enrolling in their own pension funds.

For whom is fire true?

Most people think that FIRE is for people who can generally have a pretty good income in the six figures. In fact, if your goal is to retire in your 30s or 40s, this will most likely happen. However, much can be learned from the principles of the movement that can help people save for retirement and even earn earlier if they are 40 years old. Not in age.

And remember, the first part of FIRE is about financial independence, which, if you realize it, can allow you – instead of retiring – to do something you want to do. This is what you need to do. Author Robin tells the book that FIRE isn’t just about early retirement. Instead, it teaches you how to consume less while still doing better.

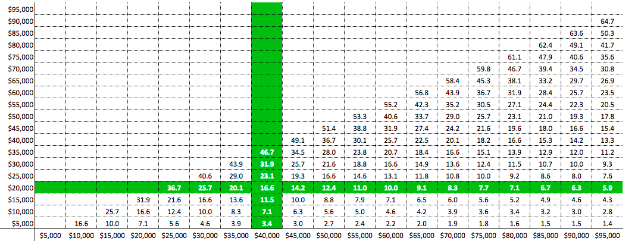

detail pictures

It’s important for everyone to plan for their retirement, however, according to a May 2021 Federal Reserve Board of Governors report, by 2020, one in four Americans will have no retirement savings, up from 36%. , realized that his retirement plan was not on the right track.

The FIRE movement stresses the importance of having and maintaining a detailed plan, the principles of which help anyone save for retirement and maintain a good emergency fund.

Financial discipline

To be able to retire from a fire, you must increase your income while reducing your expenses. Retiring at 40 will require you to go to extremes to succeed, but anyone can benefit from creating and maintaining a budget while doing what they can to make as much money as possible. Whether it’s finding a better job, adding a second job, creating an additional income stream through a secondary business, or owning a rental property.

wise investment

A person cannot achieve a secure retirement without investing in his or her retirement savings. Fire enthusiasts want to invest a larger share of their income than the average person. But starting with a fixed percentage of your monthly investment income – and starting as early as possible – will allow you to increase your retirement savings to the point where you can be financially stable for years to come. I can give

What exactly is meant by fire?

The acronym FIRE stands for Financial Freedom and Early Retirement and is a term derived from the book Your Money or Your Life by Vicki Rubin and Joe Dominguez, first published in 1992. A revised and updated version was released in 2008 and again in 2018. . .

As Rubin comments, this book is not intended to outline plans for early retirement. Its goal is to show people how to live well with less consumption, to have a more rewarding life while wasting less on the world’s resources. Or, as Robin puts it, “If you live to have it all, what you have will never be enough.”

How does firework?

FIRE enthusiasts plan to retire well before the traditional retirement age of 65, while still working full time, with up to 70% of savings income. When their savings reach about 30 times their annual expenses, or about $1 million, they can quit their day job or retire from any job.

To make ends meet after retiring at a young age, FIRE enthusiasts withdraw small amounts from their savings, usually around 3% to 4% per year. Whether in work or retirement, FIRE enthusiasts aim to eliminate overeating and enjoy a simpler lifestyle.

What is the difference between fire?

There are many variations of fire movement. Fat Fire is a simple attempt to save more, save less. Lean Fire requires a little dedication to live. Barista Fire is for those who want to leave the 9-5 rat race and are willing to cut costs while working part-time just to do so.