Personal finance books for beginners provide essential guidance and knowledge to manage and improve financial well-being effectively, empowering individuals to make informed financial decisions. In today’s fast-paced and ever-changing world, having a solid understanding of personal finance is crucial for everyone.

Fortunately, there are numerous books available that cater specifically to beginners, offering valuable insights and strategies for managing money, budgeting, investing, and planning for the future. Whether you are just starting your financial journey or looking to enhance your existing knowledge, these books can serve as valuable resources.

They cover a wide range of topics such as creating a budget, tackling debt, building savings, understanding taxes, and establishing a solid foundation for future financial success. With the right personal finance book, you can gain the confidence and knowledge needed to make smart financial choices and achieve your goals.

Why Personal Finance Books Are Important

Developing a strong foundation in personal finance is crucial for anyone seeking to manage their money effectively. Personal finance books serve as valuable resources for beginners, offering insights on how to navigate the complex world of financial management. These books provide a comprehensive understanding of financial basics such as budgeting, saving, and investing.

By delving into these books, beginners can gain essential knowledge on how to create a sustainable financial plan. They explore topics such as setting financial goals, managing debt, and understanding various investment options. Additionally, personal finance books often share real-life examples and success stories, providing readers with practical advice and inspiration.

With the information gained from personal finance books, beginners can develop good financial habits and make informed decisions about their money. They can learn about the importance of emergency funds, the benefits of automating savings, and strategies to build a secure financial future. Moreover, personal finance books often offer step-by-step guidance on how to create an effective budget and manage expenses wisely.

In conclusion, personal finance books play a vital role in equipping beginners with the knowledge and tools necessary to establish a solid financial foundation. By investing time in reading these books, individuals can gain the confidence and skills needed to take control of their finances and achieve their long-term financial goals.

Credit: moneyqanda.com

Top Personal Finance Books For Beginners

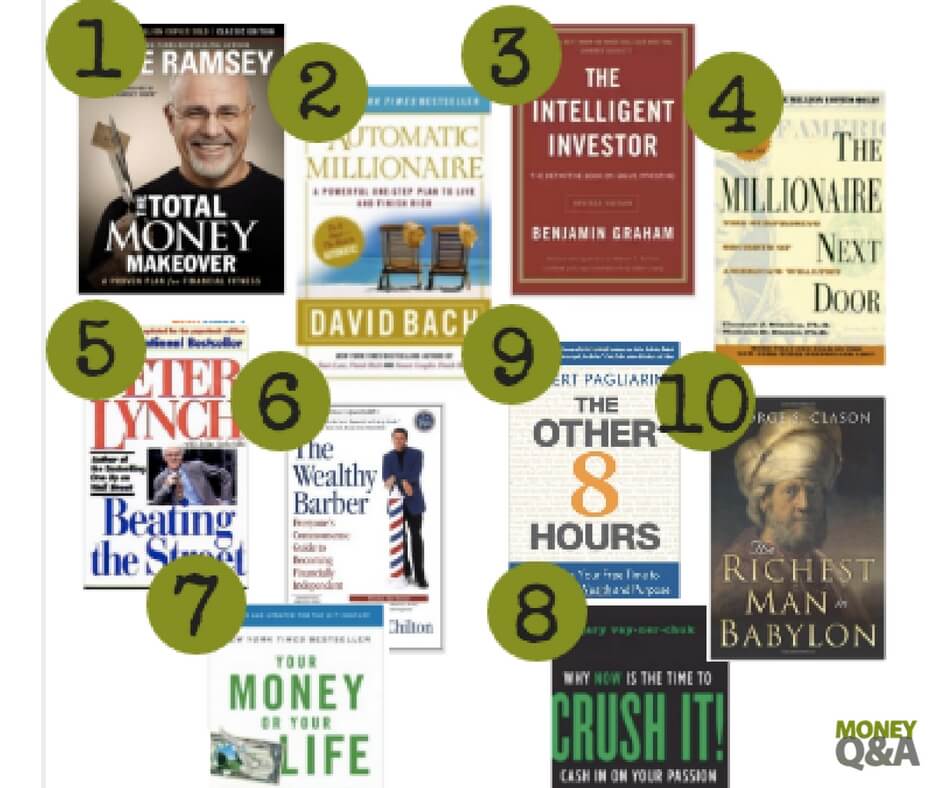

If you are a beginner looking to improve your personal finance management skills, there are several highly recommended books you can consider. ‘Rich Dad Poor Dad’ by Robert Kiyosaki is a popular choice among beginners as it provides valuable insights into financial education and building wealth. Another recommended book is ‘The Total Money Makeover’ by Dave Ramsey, which offers practical advice on how to get out of debt and manage money effectively.

I Will Teach You to Be Rich’ by Ramit Sethi is also a great option for beginners looking to establish a strong financial foundation, offering step-by-step guidance on how to achieve financial success. These books provide valuable lessons, strategies, and techniques that can help you navigate the complex world of personal finance and achieve your financial goals.

Key Lessons And Takeaways From Personal Finance Books

Key Lessons and Takeaways from Personal Finance Books

Developing a mindset for financial success is crucial in managing personal finances. It involves being aware of one’s financial goals and making conscious decisions to achieve them. Personal finance books emphasize the importance of effective budgeting and saving strategies. They provide practical tips on creating a budget, tracking expenses, and setting aside a portion of income for savings and investments.

One of the key lessons from such books is the significance of living within one’s means. This involves spending less than what one earns and avoiding unnecessary debts. Personal finance authors often stress the importance of delayed gratification and the benefits of developing a frugal mindset.

- The Best Baking Recipes for Beginners

- Best Some Easy Healthy Meal Prep Ideas

- Best 3 Yoga for Back Pain Relief

Investing wisely is another crucial aspect highlighted in personal finance books. They guide building a diversified investment portfolio, understanding different asset classes, and minimizing risks. These books often emphasize the importance of being informed and educated about financial markets.

Overall, personal finance books equip beginners with the necessary knowledge and mindset for achieving financial success. By implementing the lessons learned, individuals can take control of their finances and work towards a stable and prosperous future.

Credit: www.pinterest.com

Frequently Asked Questions For Personal Finance Books For Beginners

How Do I Start Learning About Personal Finance?

To start learning about personal finance, follow these steps:

- Create a budget to track your income and expenses.

- Educate yourself through books, online resources, and courses.

- Set financial goals and work towards them.

- Start saving and investing wisely.

- Stay informed about financial news and seek professional advice if needed.

What Are The 5 Basics Of Personal Finance?

The 5 basics of personal finance are budgeting, saving, managing debt, investing, and insurance.

What Is The Best Way To Learn Finance For Beginners?

To learn finance as a beginner, start with books that explain financial concepts in simple terms. Combine reading with online courses, videos, and podcasts to enhance your understanding. Practice managing your finances and seek guidance from financial experts. Continuous learning is key to mastering finance.

What Is The #1 Rule Of Personal Finance?

The #1 rule of personal finance is to spend less than you earn. By living within your means and saving money, you can avoid debt and build a secure financial future. Stick to this simple principle to achieve long-term financial success.

What Are The Top Personal Finance Books For Beginners?

There are several excellent personal finance books for beginners, such as “Rich Dad Poor Dad” and “The Total Money Makeover. ” These books provide practical advice and valuable insights to help you improve your financial situation.

Conclusion

To summarize, personal finance books can be key resources for beginners looking to improve their financial literacy and take control of their money. With a wide range of topics and approaches, these books offer practical advice, actionable strategies, and valuable insights into managing expenses, budgeting, investing, and building wealth.

By diving into the recommended titles discussed in this blog post, beginners can kickstart their journey toward a more secure financial future. Start reading, start learning, and start taking charge of your finances today.